|

ePay Reference Guide |

|

| You must first register before using the ePay Online Payment System. | |

| Once registered, you can login to use the ePay Online Payment System. | |

| Do I have to use the Online Payment System every month? | |

| No. You can continue to send us a Cashier’s Check or Money Order to the lockbox. However, once you have registered for the Online Payment System, you have the option each month of using the Online Payment System or sending Cashier’s Checks or Money Orders – whichever payment method is most convenient for you. | |

| What is my Online Payment ID? | |

| Your Online Payment ID is an 11 digit number consisting of your case number and the last 4 digits of your social security number. Do not use any dashes. Example: Case # 11-77777 JKC-13 and Social Security # XXX-XX-1234 The Online Payment ID is: 11777771234 (This is not YOUR Online Payment ID - only an example) |

|

| Do I need to remember and input my Online Payment ID every time I log in? | |

| No. You will only need to input this ID number the first time you register, but it is a good idea to remember this number in case you have issues in the future with the payment center. Once you have registered, you will need to use the User ID and password you created in order to log in, so be sure to remember that information. | |

| Are passwords case sensitive? | |

| Yes. | |

| I have forgotten my password. How do I get a new one? | |

| On the login page of the Online Payment Center, there is a link called Forgotten your Password? The new page will ask you to input your User name and the system will send you a new password. Once you get that new password and enter the site, you can go to settings and change your password to one of your choice. | |

| Can I have my password reset? | |

| Yes. Once logged in, click on Settings to change your password. | |

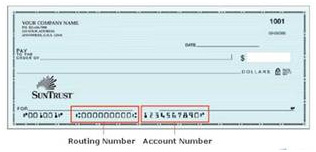

| Where do I find my Checking/Savings Routing and Account numbers? | |

| The routing and accounts numbers are located on your checks. The routing number is always a 9 digit number and to the left of your account number. DO NOT look for these numbers on a deposit slip as the routing number may be different from your checking/savings routing number. If you are unable to find your routing and account numbers, please contact your bank for help. | |

|

|

| Do I need to input my Checking/Savings account information each time I make a payment? | |

| No. The Online Payment Center will store the five most recent accounts used and you will be able to choose one from the Previously Used dropdown menu. | |

| What happens if my payment is returned as Non-Sufficient Funds (NSF)? | |

| It is very important that before you start this payment process you verify your bank account has enough funds to cover the transaction. If you submit a payment without having enough funds in your bank account to cover the transaction, the result will most likely be a Non-Sufficient Funds transaction. If this occurs, your bank account will be overdrawn and you may suffer consequences from your bank. In addition, if your payment is returned for Non-Sufficient Funds, or any other reason, your account will be locked immediately and you will not have the option of using the Online Payment System for the duration of your Bankruptcy Case. You will then be required to make your monthly plan payment by using Cashier’s Checks or Money Orders. THERE ARE NO EXCEPTIONS TO THIS RULE. | |

| How soon will the payment be taken from my account and be posted to my bankruptcy case? | |

| Payments made prior to 5:00 P.M. will be debited from your account the same day and will be posted the next business day to your case. Please visit www.indych13.com in approximately 3 business days if you would like to verify that the payment has been posted to your case. | |

| Will I receive a receipt upon making a payment? | |

| Yes. You will receive an automated e-mail with your payment information listed in the body of the e-mail. You can also go into your account history to view and print prior payments made via the Online Payment System. | |

| Can I use a debit card? | |

| No. You may only use a Routing and Account number from a valid Checking or Savings account. | |

| Can I make partial payments? | |

| Yes. If you can’t afford to make the full monthly payment owed at one time, you may make several smaller payments throughout the month. However, please keep in mind that this does not affect the due date for your payments. Even though you have the ability to make smaller payments throughout the month, the full amount of your payment is still due on your payment due date. | |

| Is there a ceiling to how much I can pay at one time? | |

| Yes. At this time $9999.00 is the largest amount you can pay at one time. This is subject to change. If you are sending a large payment that represents a tax refund, insurance proceeds, or any other payment that is not a regular plan payment, please inform our office so we may process that payment properly. Please send the payment information detailing what the payment represents to [email protected] | |

| What is the $2.00 Processing Fee? | |

| The $2.00 Processing Fee covers the cost to our bank for providing this service to debtors. The Trustee does not receive this money. | |

| Will all my payments be listed in the Payment History? | |

| The Payment History in the Online Payment Center only displays payments made through the Online Payment System. It will not display payments made to the lockbox. For additional payment information, please visit www.indych13.com. | |

| Can I setup automatic payments? | |

| No. We require each debtor to log in each month to make the monthly payment. | |

| Why are my payments held for 15 days? | |

| Payments are held for 15 business days to allow for potential discrepancies, give the payment the proper amount of time to clear through the banking system, and allow the Trustee to review the payment before disbursing to creditors. | |

| Why is my online payment account locked? | |

| There are several reasons why your online payment account may become locked. The Trustee reserves the right to lock your account and prevent a debtor from making payments online. The main reasons why the Trustee would lock an account include: a Non-sufficient Funds payment (NSF), an online payment returned for any other reason, or your case has been Converted or Dismissed. If your account has been locked and you are still required to make payments, please send Cashier’s Checks or Money Orders to the lockbox. | |

| If my case has been dismissed or converted, can I use the Online Payment System to start making payments again if instructed by my attorney? | |

| No. Until your case has been reopened, please send Cashier’s Checks or Money Orders to the lockbox. If your case is reopened, your Online Payment account will be unlocked. If the account remains locked even after your case has been reopened, please contact us so we can unlock the account. | |

Quicklinks |

|

Copyright©2005 Office of the Chapter 13 Trustee

|

Email: [email protected] |

|

Southern District of Indiana

|

Site design by Web Presence Design |

|

All Rights Reserved.

|